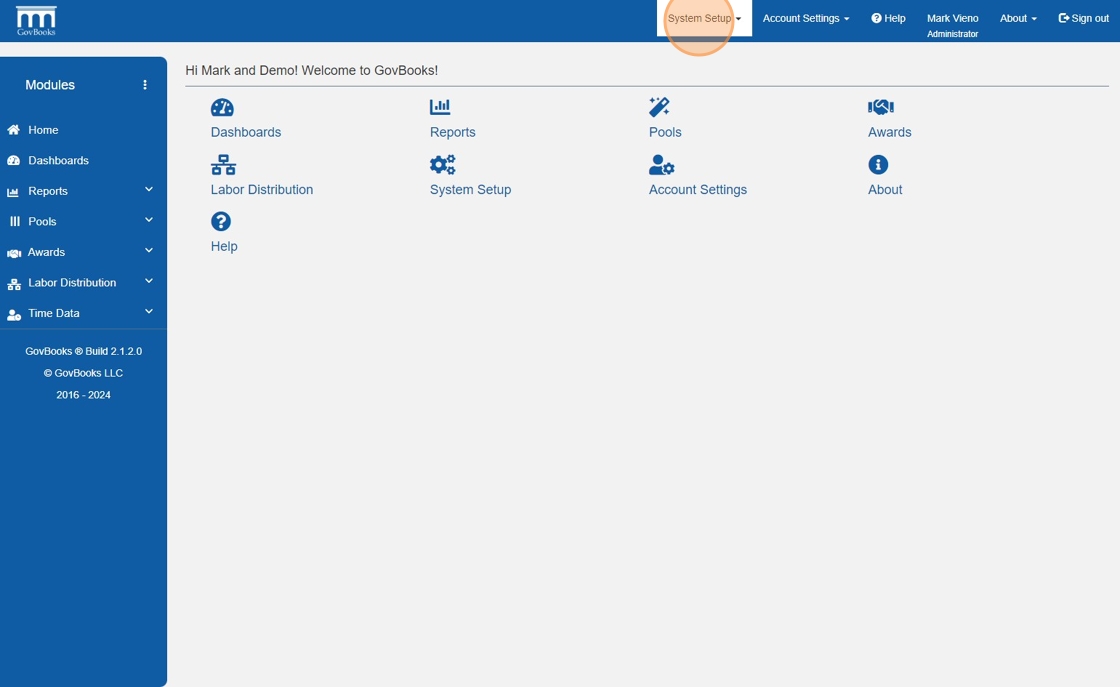

GovBooks + QBO = DCAA Compliance!

GovBooks is a feature rich, easy to use and affordable add-on for QuickBooks Online which helps small government contractors be DCAA compliant. GovBooks automates key areas where QBO is weak, for example, indirect rates, funding/backlog and labor distribution.

GovBooks was created to reduce the burden of DCAA compliance on small government contractors, and it delivers! By adding GovBooks onto the popular QBO Plus accounting software, GovBooks provides for a DCAA compliant accounting system, if properly implemented and operated. The solution is also relatively inexpensive when compared to other government contractor accounting software which can run several hundred dollars or more per month. As of November 2024, QBO Plus and GovBooks software only cost approximately $200 per month. When you add QuickBooks Time, or another timekeeping software, the total cost will probably be around $300 depending on your headcount (timekeeping software usually has a per user fee).

GovBooks adds features which are missing from QBO to make it DCAA compliant. Although these add-on features could be handled with spreadsheets, most government contractors will find it difficult—and too time consuming—to use spreadsheets after they grow beyond the initial start up stage. Manual data entry in spreadsheets is also prone to error. A direct connection, such as the one that exists between QBO and GovBooks, is preferred by management, accountants and auditors for transferring data to prepare financial and project reports.

GovBooks provides the following features for a DCAA compliant accounting system solution:

- Calculates indirect rates

- Allocates indirect expenses to contracts

- Tracks contract/grant awards, funding and backlog

- Computes the labor distribution and posts it to the general ledger

1. GovBooks calculates indirect rates

GovBooks automates the indirect rate calculation process. With the click of a button, indirect rates are calculated from the QBO chart of accounts and a report is generated showing the calculated rates for each month of the fiscal year. This is a report DCAA auditors will want to see. This is especially important if you have a cost reimbursable contract using provisional indirect rates. You would be required by DCAA to compute your indirect rates on a monthly basis so that if your actual indirect rates are less than what you are billing, you are able to reduce your provisional indirect rates on future invoices. Indirect rates are also important for pricing on bids and proposals.

2. GovBooks allocates indirect expenses to contracts

To be DCAA compliant, you are required to allocate indirect expenses to contracts at least monthly. After the indirect rates are calculated, indirect expenses are allocated based on the calculated rates to contracts to determine the total cost (direct plus indirect) for each contract. This is important so that you do not exceed the amount awarded and funded by the government. GovBooks automates this process—no spreadsheet or manual journal entries necessary!

3. GovBooks tracks contract/grant awards, funding and backlog

You have to track your contract awards, funding and backlog. This ensures compliance with contract provisions such as the Limitation of Funds clause (FAR 52.232-22). GovBooks automates this process. When tracking manually on a spreadsheet, this becomes tedious if you have more than a few contracts and task orders. Incremental funding is another challenge which requires modifications to your tracking system whenever new funds are received. Computing contract backlog becomes a major task when handled on a spreadsheet, especially when funded at the CLIN level.

4. GovBooks computes the labor distribution and posts it to the general ledger

To be DCAA compliant, you must distribute your labor costs to contracts and other cost objectives using a DCAA-approved method such as Total Time Accounting or Standard Rates. For salaried employees, Total Time Accounting requires computing an effective hourly rate for each pay period based on the actual hours worked and hours of paid leave. Employees' hours will vary from one pay period to another because they are required to record actual hours worked on their timesheets, even if the hours are more or less than a standard 40 hour work week. For the Standard Rates method of labor distribution, a payroll variance will occur, and needs to be posted to an overhead account.

Although QBO Plus and QBO Advanced versions have a labor distribution function, it is not DCAA compliant because it doesn't post labor costs to the various labor accounts required to compute indirect rates, e.g., direct labor, overhead labor, G&A labor, B&P labor, paid leave, etc. However, GovBooks' labor distribution module is fully DCAA compliant and automates the calculation of labor costs and posting to the general ledger in QBO.

GovBooks is a must have add-on for QBO which helps small government contractors automate key compliance requirements for an adequate accounting system. Do you want to learn more about GovBooks? Schedule a free consultation today!

#govcon

Disclaimer: This information on this blog, including this blog post and any comments, are intended for general information only and provided to you “as is” without any representations or warranties, express or implied. Blogs can't substitute for accounting, tax or legal advice specific to your situation which can only be obtained from consultation with a qualified professional.