QuickBooks Tips for GovCon Accounting

Author's Note: Originally posted on the Small GovCon CFO blog on March 29, 2023.

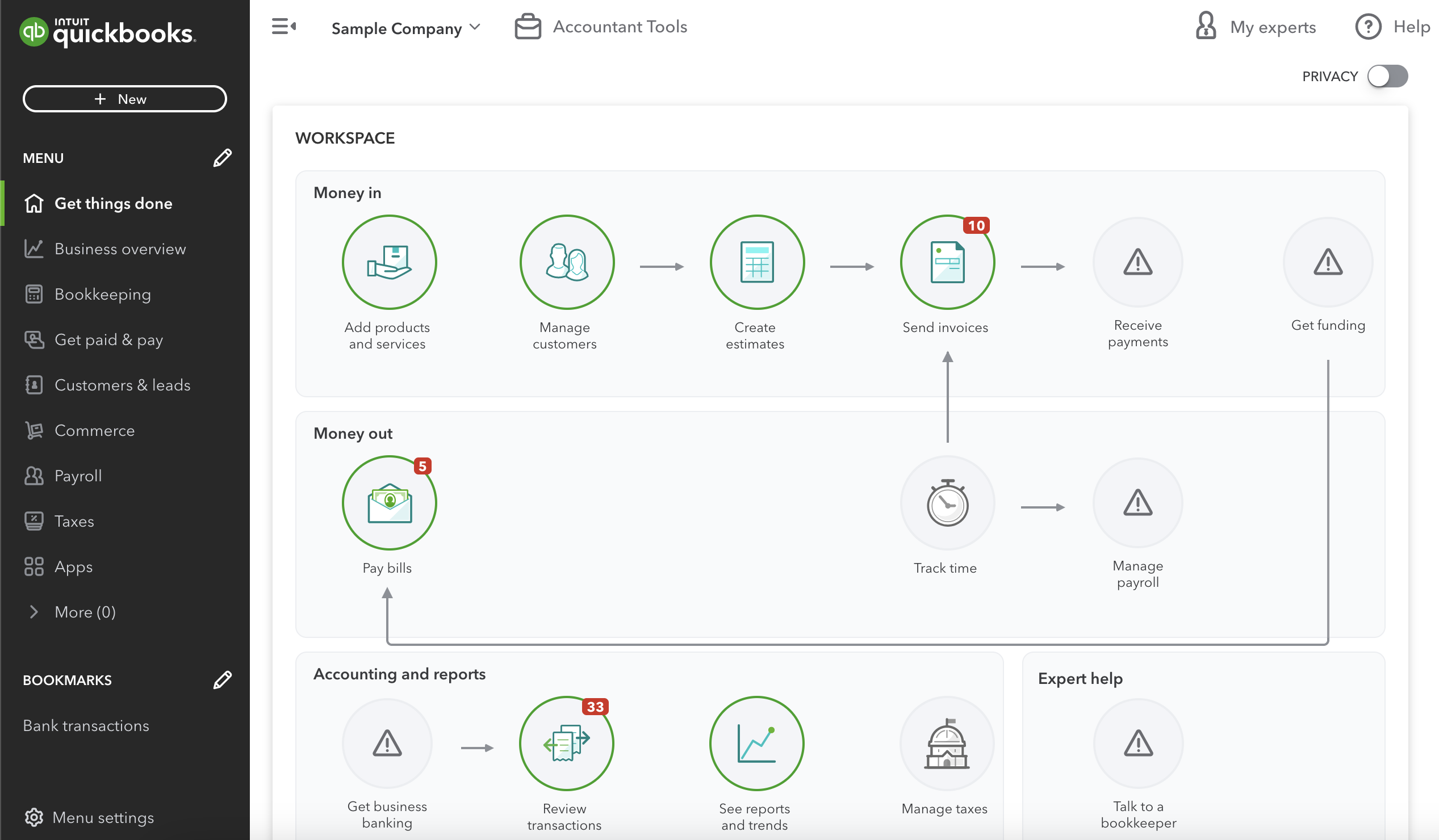

QuickBooks is a popular accounting software option for small businesses in many different industries, including government contractors. Whether you choose QuickBooks Online, or QuickBooks Desktop – it’s affordable, easy to use, comes in a variety of different plans, and there are many training and support resources available. However, government contractors should be aware that additional steps must be taken for QuickBooks to be “DCAA compliant”.

For QuickBooks (or any other accounting software) it’s important to select the best plan, configure settings, create a compliant chart of accounts, set up job costing, and process transactions correctly. The following tips will help you strive for an adequate accounting system, and ensure your long term success as a government contractor!

Select the best QuickBooks plan

In order to configure QuickBooks most effectively, make sure you have subscribed to QuickBooks Online Plus or QuickBooks Desktop Enterprise. These versions include job costing features required for government contract accounting.

Configure QuickBooks settings properly

In QuickBooks Online, these settings are found by navigating to the gear icon, selecting Account and settings and clicking the Advanced tab.

Select the accrual accounting method

Enable close books and set a closing date

Enable account numbers

Turn on project financial tracking

If you’re using QuickBooks Time, contact QBO Support to install the free DCAA timekeeping compliance add-on

Create a compliant chart of accounts

Create account numbers according to your indirect cost pools (i.e., fringe benefits, overhead and general & administrative). Organize accounts using primary and sub-account options. A common high-level chart of accounts structure is (five-digit account numbers):

- 1xxxx: Asset accounts

- 2xxxx: Liability accounts

- 3xxxx: Equity accounts

- 4xxxx: Revenue accounts

- 5xxxx: Direct cost accounts

- 6xxxx: Fringe benefits (indirect costs) accounts

- 7xxxx: Overhead (indirect costs) accounts

- 8xxxx: G&A (indirect costs) accounts

- 9xxxx: Unallowable expense accounts

Set up job costing

After each customer record is created, set up projects (for each contract)

Process transactions correctly

You must process transactions correctly in QuickBooks according to accrual-basis accounting principles.

- ✔ Enter vendor invoices as Bills (not Checks or Expenses) - use Pay Bills when you pay the vendor

- ✔ Enter customer invoices as Invoices (not Sales Receipts or Deposits) - use Payment Received when the customer pays

- ✔ Allocate payroll, direct expenses and indirect expenses to projects

- ✔ Prepare adjusting journal entries for accruals and deferrals required by GAAP (and then reverse them), e.g.: month end payroll expense, revenue recognition, depreciation, etc.

Reconcile accounts

Reconciling accounts is important to ensure all transactions are recorded and that balances make sense. Use bank statements to reconcile checking, savings and credit card accounts. Run the P&L by customer report and reconcile direct costs to the company P&L.

Finally, it’s important to note that QuickBooks is only one part of an adequate accounting system, not the adequate accounting system required for government contractors. An adequate accounting system is one that is “DCAA compliant”, or capable of passing a DCAA audit. Any accounting software can be part of an adequate accounting system if it is properly configured and operated by competent users.

Do you have questions about DCAA compliance or QuickBooks? Schedule a free consultation today!

#govcon

Disclaimer: This information on this blog, including this blog post and any comments, are intended for general information only and provided to you “as is” without any representations or warranties, express or implied. Blogs can’t substitute for accounting, tax or legal advice specific to your situation which can only be obtained from consultation with a qualified professional.